When ordering a conversion job there are two options for you to choose from which is either to convert full historical data from 1 July 2013 or ONLY opening balances from a certain month.

Full Transactional History Conversion

If you select a full transactional history conversion then you will also get payroll setup included. We will bring across active/inactive and terminated employees that have been paid during the current financial year. The employees will contain data such as:

Details, employement details, tax declaration, leave accrual, bank account details, pay template and opening balances.

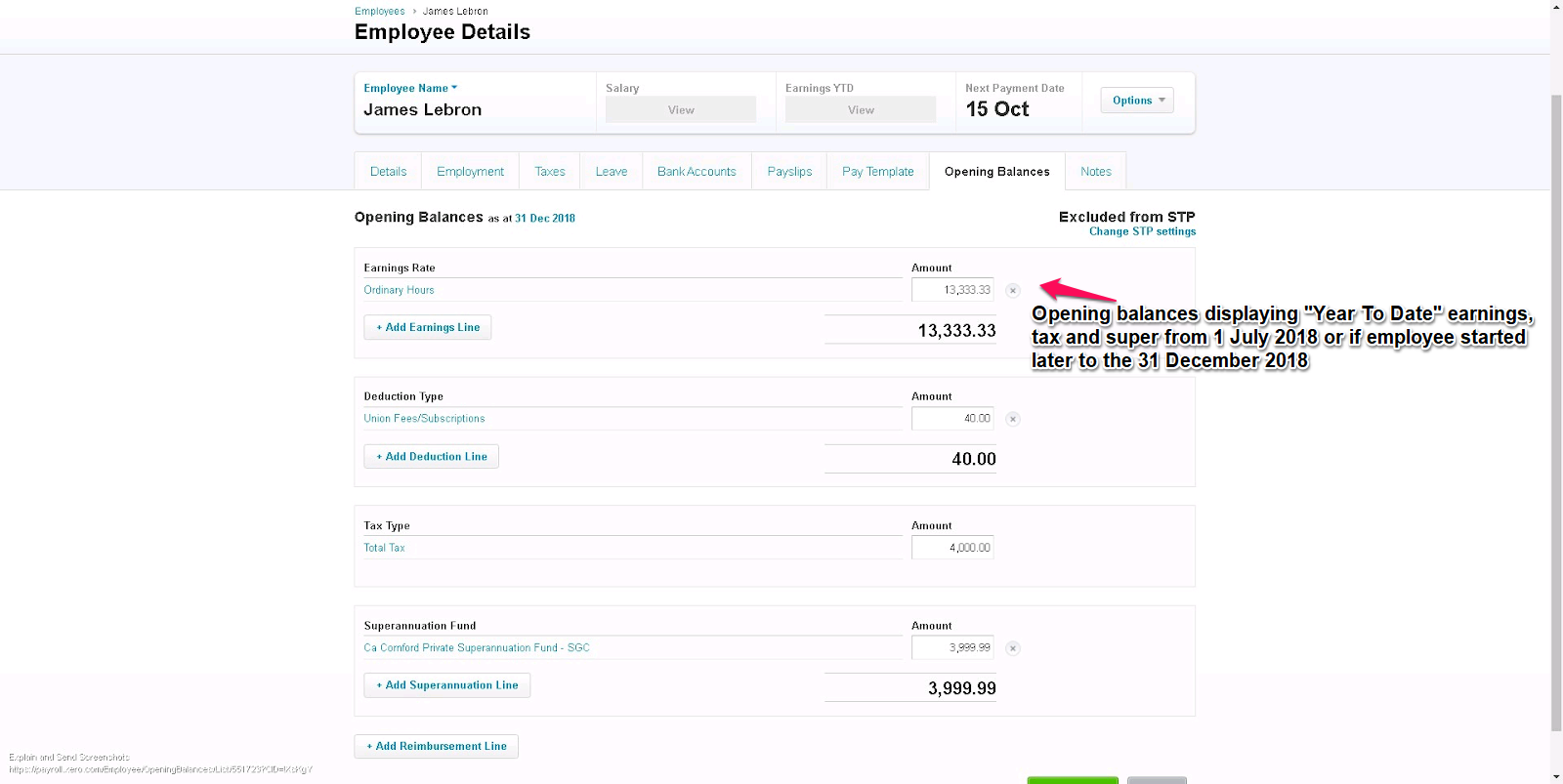

All of the above data will come across as it is in the MYOB file. We do not bring across any employer expenses aside from Superannuation. The Xero API does not allow us to push across the actual payruns that have been processed in the MYOB file. Instead we bring across opening balances which displays the year to date of what each employee has been paid. In the Xero file you will also find “paid off bills” which represents the actual payments and transactions once processed in your file.

Balances Only Conversion

If you select a conversion with ONLY balances as at a certain date then we will still bring across active/inactive and terminated employees that have been paid during the current financial year. The employees will contain data such as:

Details, employement details, tax declaration, leave, bank account details, pay template and opening balances.

All of the above data will come across if it was once setup in your MYOB file. We do not bring across any employer expenses aside from Superannuation. You will not have any transactions or “paid off bills” in the system for the payroll history.

Xero Subscription

We select the subscription based on how many employees were paid last month. For example if 8 employees were in the last payrun the subscription chosen would be Premium 10. The minimum subscription type we can choose is “Standard” as that is the level at which subscriptions can be transferred between different parties. If and when you need to upgrade your level of subscription this can easily be done in your Xero by accessing the “Info” button next to the organisation name. The same button can be used to downgrade the subscription type.

Preparing Your First Pay Run in Xero

To access the payroll after conversion make sure that you have the correct User settings, which is “Payroll Admin”.

- How to change User Settings for Payroll.

As mentioned above the Xero API does not allow us to push across the actual pay runs that have been processed in the MYOB file so instead we bring across opening balances which displays the year to date of what each employee has been paid. The implication is that your reporting for the first quarter/first month does not readily give the correct figures for earnings, PAYG and super. To get those you will need some details from your old system. Here is an example on how to get the correct figures:

Sometimes during conversion some of the deduction and reimbursement pay items have been linked to the account code 199, “MYOB Conversion Account”. This account is an account that you should not use in your Xero life, it needs to be unlinked from these pay items before preparing a payrun in Xero. The reason why the account has been linked during conversion is that in the MYOB file these pay items may have been linked to a bank account or asset account etc. In Xero you can only link deduction pay items to a liability account and reimbursement pay items to either a liability account or an expense account. Make sure you update the chart of accounts and create the accounts needed, or change any accounts to what it needs to be in order to work correctly.

Superannuation not being calculated for employees reaching the threshold of the minimum amount $450/monthly.

If you have a conversion completed in the middle of a BAS period then you might have to manually add super amount onto a payslip for an employee member that passed the minimum threshold on earning.

Example:

You have created the payroll in the MYOB file until the 15 March 2014 and in the conversion process we bring across YTD amounts into the “Opening balances” for all of your employees until this specific date. One of your employees has at this point in time only had gross earning on the amount of $300. You are just about to create your first pay run in Xero for the period 16 March to 23 March and that specific employee will now receive $200 which means that the threshold has been reached and super needs to be calculated on the earnings. Xero does not take into account the $300 sitting in the opening balances which means that Xero does not calculate any super. You will have to manually add the super on the payslip for this employee this period. During April month and in the future this will not be an issue since Xero will calculate this automatically for you while processing your pay runs.

Sometimes PAYG might have differences between MYOB and Xero.

In MYOB it is possible to use rounding in the payroll section while in Xero this is not possible. This can result in that when you create your first pay run in Xero the PAYG amount might differ slightly to what the previous software was showing you since the rounding adjusts the PAYG.

Salary Sacrifice being setup in your MYOB as a deduction type.

In Xero a salary sacrifice related to super needs to be setup as a superannuation line to appear in the correct area in the payment summary report and in the payroll reports. We have found that a lot of client has setup these items in the wrong way in MYOB which means that it will unfortunately be brought across in the wrong way into Xero. Make sure you look at your original file and note if this was setup wrongly in order to correct the mistake in Xero.

Because we do bring across the above information you will be able to create your payment summaries from within Xero for the financial year which will save you a lot of time and the hassle as you do not have to work in your MYOB file.

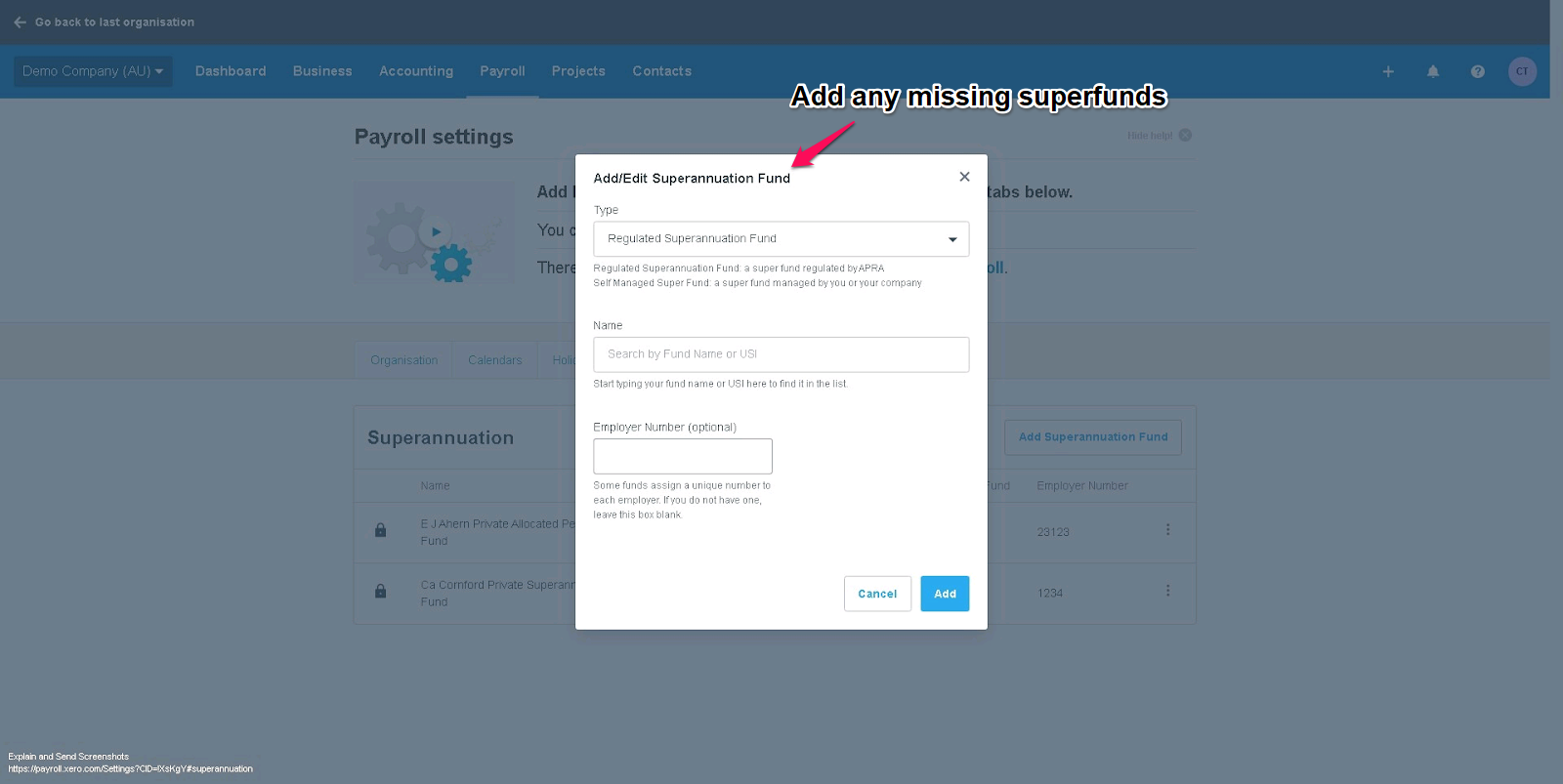

Superfund Names

Sometimes a superfund or some of your superfunds linked to the employees may be missing. We have a mathematical formula that decides if it will be brought across based on how the name matches the funds in Xero. If a superfund is missing it will be because we did not have enough details in the MYOB file to bring it across accurately into Xero. One example is superfund “AMP”, which can be one of nine different superfunds depending on the name and spin number. If you only have the name “AMP” in MYOB it does not sufficiently match any fund names in Xero and so will not be brought across. If you have the name “AMP Flexible Lifetime” in MYOB and not the real name “AMP Flexible Lifetime Super” then it matches by 75% and will come across as “AMP Flexible Lifetime Super”. Since in MYOB you cannot enter the SPIN, make sure you have the entire name for the specific fund to ensure it comes across properly. SMSFs will not come across from MYOB as there is no equivalent fund in Xero. You will need to set these up in Xero following conversion.

Details Missing In Your Employee Cards From MYOB, don’t worry we will HELP you!

To ensure you have a good experience when processing your first pay run in Xero we recommend you have a look at our post conversion instructions report which is unique for each conversion that we complete. We point out details that were missing in the file and believe is essential that you add to the Xero payroll settings and employees. We have found that sometimes payroll have not been updated. Details that we point out to you include: Super funds missing with and without the super fund name, email address, postal address, date of birth missing, super fund missing in the employee or super fund membership number missing, tax file number missing or pending and bank account details etc. The post conversion instructions is your invaluable aid to getting started in the new Xero org.